3 Easy Facts About Custom Private Equity Asset Managers Described

Wiki Article

Not known Factual Statements About Custom Private Equity Asset Managers

You have actually possibly become aware of the term exclusive equity (PE): investing in firms that are not openly traded. Approximately $11. 7 trillion in possessions were managed by private markets in 2022. PE firms seek possibilities to earn returns that are far better than what can be attained in public equity markets. There may be a few points you don't understand concerning the market.

Personal equity firms have a range of financial investment choices.

Due to the fact that the best gravitate toward the bigger bargains, the center market is a considerably underserved market. There are much more sellers than there are very skilled and well-positioned financing professionals with comprehensive purchaser networks and sources to take care of an offer. The returns of private equity are normally seen after a few years.

3 Easy Facts About Custom Private Equity Asset Managers Described

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Flying listed below the radar of large multinational firms, most of these little firms frequently give higher-quality customer support and/or specific niche services and products that are not being supplied by the big empires (https://peatix.com/user/20144170/view). Such benefits attract the rate of interest of exclusive equity companies, as they have the insights and savvy to make use of such opportunities and take the firm to the next degree

Private equity investors must have trusted, qualified, and reputable administration in place. Most managers at profile business are provided equity and incentive compensation frameworks that compensate them for hitting their financial targets. Such positioning of goals is normally required prior to a bargain gets done. Personal equity opportunities are usually unreachable for individuals that can not spend countless bucks, yet they shouldn't be.

There are regulations, such as limitations on the accumulation amount of money and on the number of non-accredited investors. The exclusive equity organization draws in a few of the ideal and brightest in company America, including leading performers from Ton of money 500 business and elite administration consulting firms. Regulation Read Full Report companies can also be hiring premises for personal equity works with, as accounting and legal abilities are needed to complete deals, and transactions are very looked for after. https://custom-private-equity-asset-managers.jimdosite.com/.

What Does Custom Private Equity Asset Managers Mean?

One more negative aspect is the absence of liquidity; when in an exclusive equity transaction, it is difficult to leave or offer. There is a lack of versatility. Exclusive equity additionally comes with high fees. With funds under administration already in the trillions, private equity firms have ended up being appealing investment vehicles for well-off people and organizations.

For decades, the characteristics of exclusive equity have actually made the property class an eye-catching suggestion for those that could get involved. Since access to private equity is opening approximately more specific investors, the untapped potential is coming true. So the question to consider is: why should you invest? We'll begin with the major arguments for purchasing exclusive equity: Exactly how and why exclusive equity returns have actually historically been greater than various other possessions on a number of degrees, How consisting of private equity in a profile impacts the risk-return account, by helping to diversify versus market and intermittent danger, Then, we will detail some vital considerations and dangers for exclusive equity investors.

When it concerns introducing a brand-new asset right into a profile, the a lot of standard factor to consider is the risk-return profile of that possession. Historically, personal equity has exhibited returns similar to that of Arising Market Equities and higher than all other traditional asset classes. Its fairly low volatility combined with its high returns creates a compelling risk-return profile.

The 9-Second Trick For Custom Private Equity Asset Managers

In truth, private equity fund quartiles have the largest series of returns throughout all different possession courses - as you can see below. Method: Interior rate of return (IRR) spreads out computed for funds within vintage years independently and after that balanced out. Typical IRR was computed bytaking the average of the average IRR for funds within each vintage year.

The effect of adding private equity right into a portfolio is - as always - reliant on the profile itself. A Pantheon study from 2015 suggested that consisting of personal equity in a profile of pure public equity can unlock 3.

On the various other hand, the most effective exclusive equity companies have access to an even larger swimming pool of unidentified chances that do not deal with the exact same examination, along with the resources to carry out due diligence on them and recognize which deserve spending in (Private Asset Managers in Texas). Spending at the first stage implies greater threat, but also for the companies that do be successful, the fund gain from higher returns

The Ultimate Guide To Custom Private Equity Asset Managers

Both public and personal equity fund managers devote to investing a percentage of the fund however there continues to be a well-trodden concern with straightening rate of interests for public equity fund management: the 'principal-agent issue'. When a financier (the 'primary') employs a public fund supervisor to take control of their resources (as an 'agent') they hand over control to the supervisor while retaining possession of the assets.

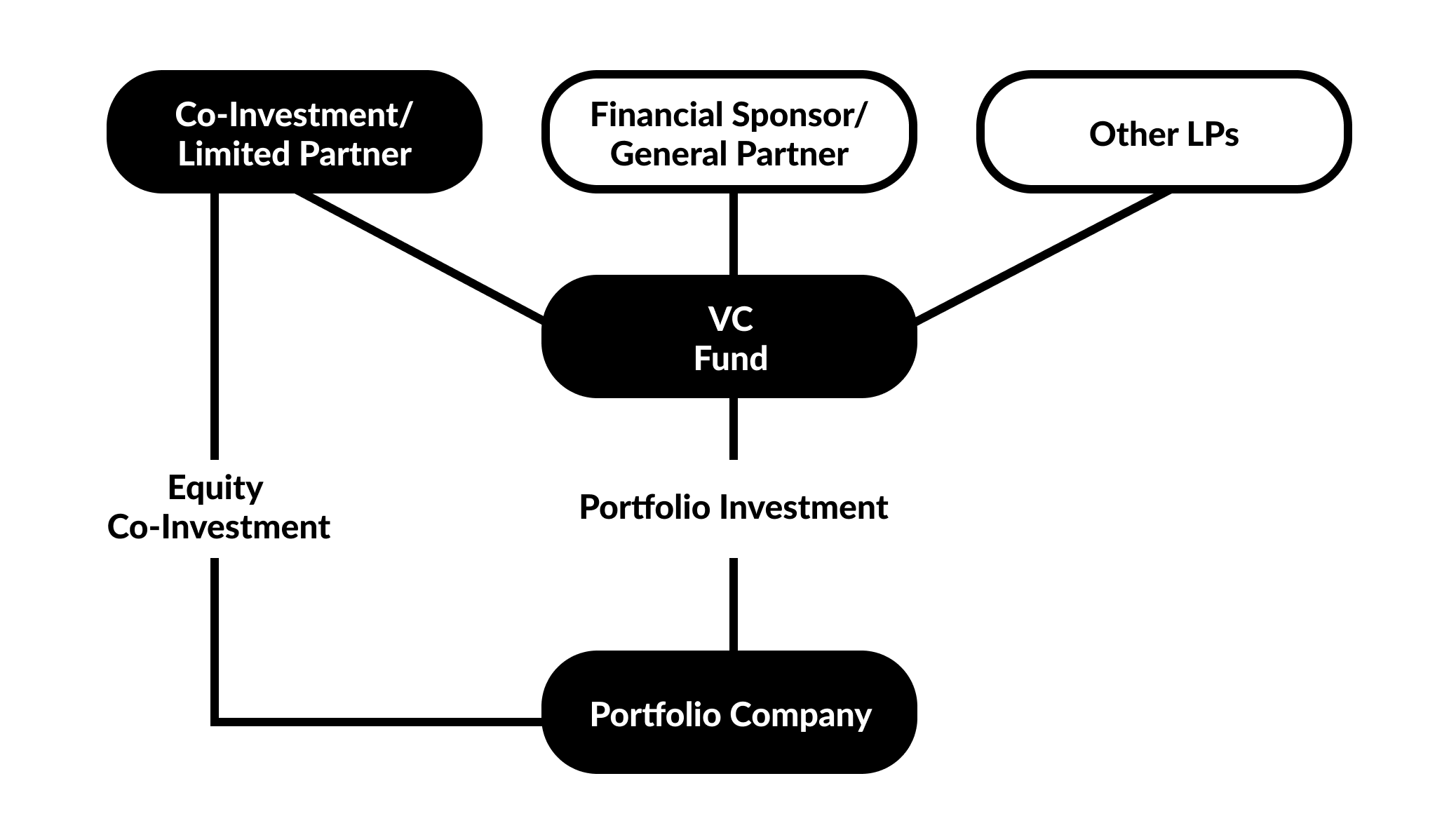

In the instance of private equity, the General Companion does not simply make a management fee. They also make a percentage of the fund's revenues in the type of "bring" (normally 20%). This makes certain that the interests of the manager are aligned with those of the financiers. Personal equity funds additionally alleviate an additional kind of principal-agent trouble.

A public equity investor eventually desires one point - for the administration to boost the supply cost and/or pay out returns. The financier has little to no control over the decision. We showed above the number of private equity approaches - especially bulk buyouts - take control of the operating of the business, making sure that the long-term value of the company precedes, rising the roi over the life of the fund.

Report this wiki page